January 3, 2010 ~ During the past twenty years, there have been two implosions in the residential real estate market, the first in the early 1990’s, while Daddy Bush”s Desert Storm was commencing, the second beginning during the waning years of the Presidential Administration of his lame duck son, sometimes known as, ‘Shrub.’

January 3, 2010 ~ During the past twenty years, there have been two implosions in the residential real estate market, the first in the early 1990’s, while Daddy Bush”s Desert Storm was commencing, the second beginning during the waning years of the Presidential Administration of his lame duck son, sometimes known as, ‘Shrub.’

Junior’s implosion, led America to the devastating administration of the Unknown Muslim, one Barry Soetoro, AKA, Barack Hussein Obama – the REAL uninvited guest of 1600 Pennsylvania Avenue.

It took nearly ten years for the first market condition to come full circle, and actually show a profit – for most. America may never recover from the bubble-pop of 2006.

As many of readers of the Federal Observer, and listeners of my broadcasts were aware, my wife and I were both the winners and losers of the most recent ‘land grab’ by the international banksters – the money-changers of modern times.

In mid-1990, we purchased a home in Phoenix, Arizona for $142,000, and a few months later, I lost my job. Operation Desert Storm began a short time later, and the value of our home began to plummet, and when it hit bottom, we effectively had lost over 15% of our home’s value. Exactly thirteen years to the day since we purchased the home, we moved out with a very handsome profit of nearly 70% above what we had originally paid for the property. Man, were we living on easy street now.

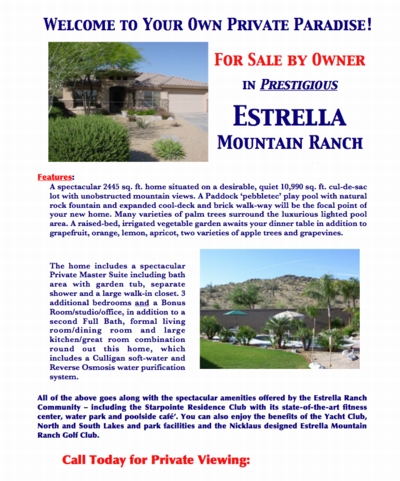

The home we then purchased cost about $20,000 less than the one, which we had just sold. On the day we agreed to purchase the property directly from the seller (FSBO), we agreed to pay his asking price. When we finally took possession some months later, we realized that he hadn’t been too smart and actually sold the home to us for considerably under what the legitimate market value was at the time. It’s why we bought the home – we had been looking at plenty and knew a great value when we saw it, however we were biting a much larger mortgage ‘ but went in with plenty of equity, so we weren’t worried. Besides, my wife was teaching and I owned my own business, which I managed from home – what did we have to worry about??? We had a B-I-G home on about 1/4 acre, nestled at the base of a mountain in a nice, quiet, managed subdivision about 25 miles from downtown Phoenix. Cleaner air, not much traffic, and we could see the stars at night due to the lack of light pollution. We had a large yard with a garden of both flowers and vegetables, a half dozen or so citrus trees, two apple trees and a couple of apricot trees, which bore fruit the first year. And we had a romantic swimming pool with a waterfall, that we could swim naked in, under the stars.

Then my work began to falter. But no problem – the real estate market was growing by leaps and bounds and we had nothing to worry about.

In November of 2004, having legally been the owners (along with the mortgage company) of our new home for a mere 13 months, I wasn’t sure how we were going to survive my economic downturn, so I called my friendly loan-shark, Pasquale to inquire about a new mortgage – considering the fact that we believed that we had built up some substantial equity – and man – were we in for a shock. In thirteen months, the value of the home had gone from our original purchase price of $220,000.00 to an appraised value of $350,000.00 – a nearly 60% gain.

In November of 2004, having legally been the owners (along with the mortgage company) of our new home for a mere 13 months, I wasn’t sure how we were going to survive my economic downturn, so I called my friendly loan-shark, Pasquale to inquire about a new mortgage – considering the fact that we believed that we had built up some substantial equity – and man – were we in for a shock. In thirteen months, the value of the home had gone from our original purchase price of $220,000.00 to an appraised value of $350,000.00 – a nearly 60% gain.

THIRTEEN FREAKIN’ MONTHS! It was like money in the bank – and we took some of it. We settled some corporate bills with broadcasters and took care of a few other things as well. We knew we would be alright now.

But we weren’t..

Business did not improve and my audience was not able to hear me as often, due to changes in my broadcast hours and schedule – late at night – you know, where Bill Cooper once aired his program. Except by this time, Bill had been gone for 5 years and nobody was tuning in looking for him.

Three months after we had re-mortgaged the house, I knew that our ship was sinking – faaaaaast! My wife would be through with her contract by May, and would not see another pay-check until late August, so we had to have a talk. The decision was made to sell the house, for if not – we wouldn’t be able to make the payments and we would ultimately lose it – and back in 2005 – the markets were exploding – and the bank would have grabbed that house in 90 days.

We ordered another appraisal through Pasquale, and his man came back with an even bigger surprise, when he discovered that in the three and a half months since we had refinanced the home, it had continued to spike, now reaching a value of $450,000.00 – over twice what we had paid for the home in October of 2003.

BANG!

I wrote up the ad for our first Open House, and we were swamped. Real Estate Agents from all over the Valley brought their clients, and many remarked, that they had never seen such a huge turnout before – and they were supposed to be ‘Pros’ (prophylactic’s we discovered!). By the time the first day was over, we were actually negotiating with three very live and apparently qualified buyers. The first loved the home, lived in the neighborhood, but it turned out that they were not financially qualified, as they needed to sell their present home, which wasn’t even on the market.

I wrote up the ad for our first Open House, and we were swamped. Real Estate Agents from all over the Valley brought their clients, and many remarked, that they had never seen such a huge turnout before – and they were supposed to be ‘Pros’ (prophylactic’s we discovered!). By the time the first day was over, we were actually negotiating with three very live and apparently qualified buyers. The first loved the home, lived in the neighborhood, but it turned out that they were not financially qualified, as they needed to sell their present home, which wasn’t even on the market.

The second couple had driven over from California, having seen our ad in the Orange County Register. Whoosh – this house would have been 2 million bucks in Ahnold country. They fell in love – BUT – had a teenage daughter at home, that they were going to have to convince to make the move. You know those ‘Valley Girls.’ They left that afternoon, to return home – but they would be back another day.

The third couple wasn’t a couple at all. It was a single gal with two unruly rug rats, who jumped all over our furniture as if they were monkeys in a zoo. This gal went bonkers, and told her boys, “C’mon, we have to go call Petey.” Petey? Who the hell is Petey? Wasn’t he the dog from the Little Rascals and Our Gang movie shorts of the 1930s and 40s? I figured that Petey must be her boyfriend, or maybe her brother.

The third couple wasn’t a couple at all. It was a single gal with two unruly rug rats, who jumped all over our furniture as if they were monkeys in a zoo. This gal went bonkers, and told her boys, “C’mon, we have to go call Petey.” Petey? Who the hell is Petey? Wasn’t he the dog from the Little Rascals and Our Gang movie shorts of the 1930s and 40s? I figured that Petey must be her boyfriend, or maybe her brother.

She loaded her rascals into the van and took off down the hill. Forty-five minutes later shes back – sitting in the van out in front of the house. Shes drooling and slobbering all over herself – not for the house – but because ‘Petey’ was coming from California the next day to see the place, she told me. She was drooling at the thought of Petey, and what she might do to him in that big bed of ours, if he would buy the place and move in – even if it was her brother.

The strange thing about this weekend was, that it was NASCAR weekend at P.I.R. (Phoenix International Raceway) and the traffic was hell on all freeways coming into our area, but it didn’t stop the people coming to our open house – in droves. There were probably 150 people, who showed up on that Saturday – but trouble lurked ahead!

About mid-afternoon, we received a phone call from a couple from Scottsdale, who were on the way out to view the home for their son, who apparently lived out of state, but because the traffic was so bad, they turned around and went back home. They called us back to inform us of their traffic dilemma and gave us their name, letting us know that they would be in touch. At that time, they also informed us that they were Real Estate agents, but that they were actually going to be representing their son in his quest to purchase a new home in the area.

We never gave it a second thought, as we were busy enough – including talking with our neighbor, a fledgling real estate agent with a thick, sour Southern drawl, who just couldn’t figure out “Wha y’all hadn’t laisted y’all’s haus with a professional?” It was easy (as we were to find out – she couldn’t deliver an ant to a sugar hill – but more on that later.

Scarlett O – Real Estate Bimbo

Later in the day, we got a call from Petey, who asked a few questions and told us that he would be at the house at 10:00 a.m. the next morning, as he was driving over from California. Petey was right on time, with his wife, Nancy – and you guessed it – his parents – the Real Estate agents from Scottsdale. The moment they walked into our home, I put out my hand and said, “Mrs. Blackmun, I presume?” Her composure was shaken. “How did you know?“, she asked. She was a very regal, imposing, and formidable woman, who was used to getting her way. She and I got along quite well from that moment on. I have not spoken to her in several years now, but think of her often.

The normal pleasantries were exchanged, with a bit of the usual, “let’s get comfortable with each other” idle chit-chat, while Petey and the wife looked the house and property over, along with Petey Sr. – the pilot. While all of this was taking place, Mommy had already seen enough, and decided that it was time for her and I to get down to business. Her proposal? Petey will pay our asking price, but that Mommy would represent his interests for a 2% fee. Frankly, I was pissed off, as it was my advertising, which had brought all of the various parties together on this deal, and why should I pay 2% to her for something she had nothing to do with? But we agreed on the deal and settled it all with a handshake, with the understanding that once Petey returned to California the next day, he would speak with his employer, to verify the transfer to Phoenix, which they had previously offered him. That was good enough for me, and we all shook hands and said our good-byes.

A quick side note: During our discussion and negotiation, I inquired of Mommy, about the woman and her kids who had come to see the house first and what her relationship was to the family, and her reply was, “She thinks that she is going to be the next Mrs. Blackmun, but that will never happen.” Okkkkkkkay, I thought to myself.

That day, April 23, 2005, Kurt Busch won the Spring NASCAR race at P.I.R.

The house was sold. That night, the wife and I opened a bottle of wine, and went for a midnight swim – naked!

The house was sold. That night, the wife and I opened a bottle of wine, and went for a midnight swim – naked!

Tuesday came and Mommy called to inform us that the deal would be on hold, as Petey’s company was going though some downsizing and that he would not be getting transfer at that time. We were not happy about it, but we had already scheduled another Open House for the following weekend, at which time, Couple #2 returned. They had spent considerable time on the phone with the local High School (the same one, which my wife was teaching at) to determine whether the schools curriculum would meet their daughter’s needs, and they had returned from California to visit our home once more. We spent a considerable amount of time going over specific details of a possible sale, but alas – it was not meant to be, for they purchased another home in the neighborhood, which we did not become aware of for several weeks.

I spent the next two weeks, showing the house to numerous prospective buyers and their agents, but nothing came of it. We were getting nervous, and made a decision to “Laist ouah haus with a professional?” the neighbor and her Broker, who was a BIG name in the community. We asked for three exclusions, Petey, Couple #2 and one other person of possible interest. Scarlett O’Hara (who actually looked more like Ruth Bader Ginsburg) told us that, “We cain’t possibly allow those exclusions for moah than two weeks.” We agreed, figuring that this was the way it is in the Real Estate profession – after all – she was ouah nayboah, and wouldn’t lah to us. We signed the contract and began again.

One day AFTER the exclusion clause had expired, I received a call from the Broker, Nancy Fatwa (name changed to protect the guilty), informing me, that she had received a fax that morning with an offer to purchase the house. The offer was from Mrs. Blackmun – mother of Petey. The market was slowly beginning to turn downward, and Mommy figured that she could hammer us a bit. Not only did she, but instead of costing me 2% of the original selling price, because I had this other realtor involved in the mix, it was going to cost me 6%. Fatwa said to me, “Oh Jeff, if this only would have come in yesterday – you know I would have waived the commission, but you know that the company now has expenses in on this transaction!“

Oh sure you do, you chubby pig. Your Southern bimbo walked across the street with a case of ;bottled watuh, and some hoam maay-ed cookies’ and used my fliers because they were far better than the crap you people had made up. Your Open House didn’t draw six couples, because your ad was just as cheap as the rest of the industry tries to get by with – and you think that you are owed something?

The house was sold for $425,000.00 less the requisite commissions and fees and we got hammered.

The house was sold for $425,000.00 less the requisite commissions and fees and we got hammered.

Having felt burned by this commission business on the sale of the house, I contacted the Arizona Board of Realtors to inquire about this “law”, which had been represented to us regarding the ‘exclusion’ clause, only to be told that there was no such law, that exclusions had no expiration, so long as they are originally itemized in the listing contract. I should have gone after their licenses for fraud – but never got around to it. After all – it was my money and advertising that brought the buyer to our door – not the Broker and her Southern Handmaiden. Shortly afterward, the novice agent (“Oh, fiddle-de-dee!”) dropped out of the industry. It turns out, that every transaction she had been involved with, ended in difficulty, whether on a sale or a rental/lease agreement. She lied through her ‘honee drippin’ teath‘ to every Yankee she came in contact with. I often wondered what she did with her husband’s cigars, while he was away.

We purchased another home closer to our grandchildren for $319,000.00 – about $40,000 under its market value. We paid off a bunch of debts and banked some money, and in the overall scheme of things – we did OK. We pumped some money into floor coverings and paint – but discovered some major problems with the new house, which had never been disclosed. By the time we had completed the remodeling on the new house, in addition to having some extensive work done to the concrete slab, which passes for a foundation, we could have put this house back on the market for as much as $409,000.00. My wife and I discussed a more moderate figure of $388,000.00, as we felt that it had been a mistake to purchase this place and wanted out. We knew there would be more problems in the future. It was not meant to be.

By September of 2005, I was back on top of my game, after basically not working for several months and providing no income toward the needs of my family. For the next eight months, I made about twenty grand a month, which allowed us to complete many projects and personal commitments. In May of 2006, my wife and I took our first cruise to Alaska. A month earlier, the market was beginning to drop at a more rapid pace – but I was making so much money at the time, I had no time to pay attention. By now, we had $369,000 in the house, including what we paid for it, the necessary renovations and the resurfacing of our swimming pool (a necessity in 115? summer temperatures).

It’s now January of 2010, and contrary to the Goristas and their uninformed Global Warming ‘scientists’ (small ‘s’) – it’s been a long, cold winter since we purchased this home. The Bubble Burst, thanks to Mr. Greenspan and his Cabal of International Crooks and Thieves – the Mortgage Bankers and their handlers.

We would be lucky to find a buyer for $120,000.00 today – a loss of nearly 66%. Our $132,000.00 down payment? GONE! The $50,000.00 in renovations spent – in cash? GONE! We will be lucky to break even in ten years – and with depreciated dollars at that. The house is worth today, exactly what it sold for – brand new – in 1992.

How could all of this have happened? Other than a poor decision made with Nancy Fatwa and Scarlett O’Hara, and the purchase of a home with more than the ordinary problems one would acquire along with a “used” home, we – along with millions of other Americans – became victims of an industry conceived in FRAUD.

In my next installment of this series (which I will write, when I get around to it.), we’ll cover – or uncover, just how the FRAUD was, and continues to be perpetrated by the International Bank of Crooks & Criminals,

Until then…

Without Apology I am,

Jeffrey Bennett

~ the Author ~

~ the Author ~

A veteran of Viet Nam, student of history (both American and film), Jeffrey Bennett has broadcast for over 24 years years as host of various programs and has been considered the voice of reason on the alternative media – providing a unique and distinctive broadcast style, including topics such as health and wellness, news, financial well-being, political satire (with a twist), education and editorial commentary on current events through the teaching of history. In addition, he is the CEO of Kettle Moraine, Ltd.